Complete India Payroll Management for US Companies is a hard yet very important process when US firms hire workers in India. The system has many rules, tax duties & labor laws at both central & state levels. The choice to run an In House payroll model or trust an Employer of Record (EOR) is key. The blog shows the differences, benefits, costs & issues in both models to help companies make the right choice.

Understanding India Payroll Landscape for US Companies

The US companies that hire in India must deal with rules like central laws on labor codes, tax cuts at source, social security like Provident Fund & Employee State Insurance & GST in some cases.

The state rules need Shops & Establishment Acts, Professional Tax & local holidays.

The duties include benefits like gratuity, bonus, paid leave & maternity leave.

The process also needs payroll timing, currency exchange & privacy of data.

The two models for payroll are in house & EOR.

In House Payroll vs EOR: What Are They?

In House Payroll Model

The in house payroll model means the US company sets its own systems & may build a legal setup in India to handle hiring, payroll, benefits & law needs. The full duty is on the company to make contracts, pay taxes, handle benefits & issue payslips.

Employer of Record (EOR) Model

The EOR is the legal boss for the staff in India on behalf of the US company. The US company fixes roles & salaries but the EOR manages contracts, payroll, tax, social security, benefits & reports. The EOR lets the US company hire in India fast without making its own legal unit.

Key Benefits & Challenges: In House vs EOR in India

Aspect | In House Payroll | EOR |

Compliance burden | The load is high. Company must keep track of laws, tax rules & labor code updates. Risk of fines or legal issues is high. | The load is low. EOR knows the law well & takes away much risk. |

Time to set up | The time is long. Setup of legal unit, payroll team & systems takes time. | The time is short. EOR has ready systems & teams. Hiring starts fast. |

Cost structure | The cost is high at first for setup, tools & staff. The cost to keep is also high. | The cost is fee based. Each worker has a set fee. It is more steady. |

Control & choice | The control is full. You can plan all rules, pay & systems. | The control is less. You depend on EOR set rules. |

Scalability | The growth is hard. More staff & laws need more teams & audits. | The growth is easy. EOR can add staff fast. |

Risk | The risk is high if mistakes happen. Late filings & wrong pay cause issues. | The risk is shared. EOR takes much of the load. |

What Current Trends Tell Us

The firms with global work are now using EOR or outside payroll. The in house model is less common.

The rules in India are heavy with many Acts & duties on labor. Many firms find it hard to cope.

The EOR market is now more wide. The EORs give full support for contracts, payroll, benefits & law. Some have live alerts, digital joining & AI for updates.

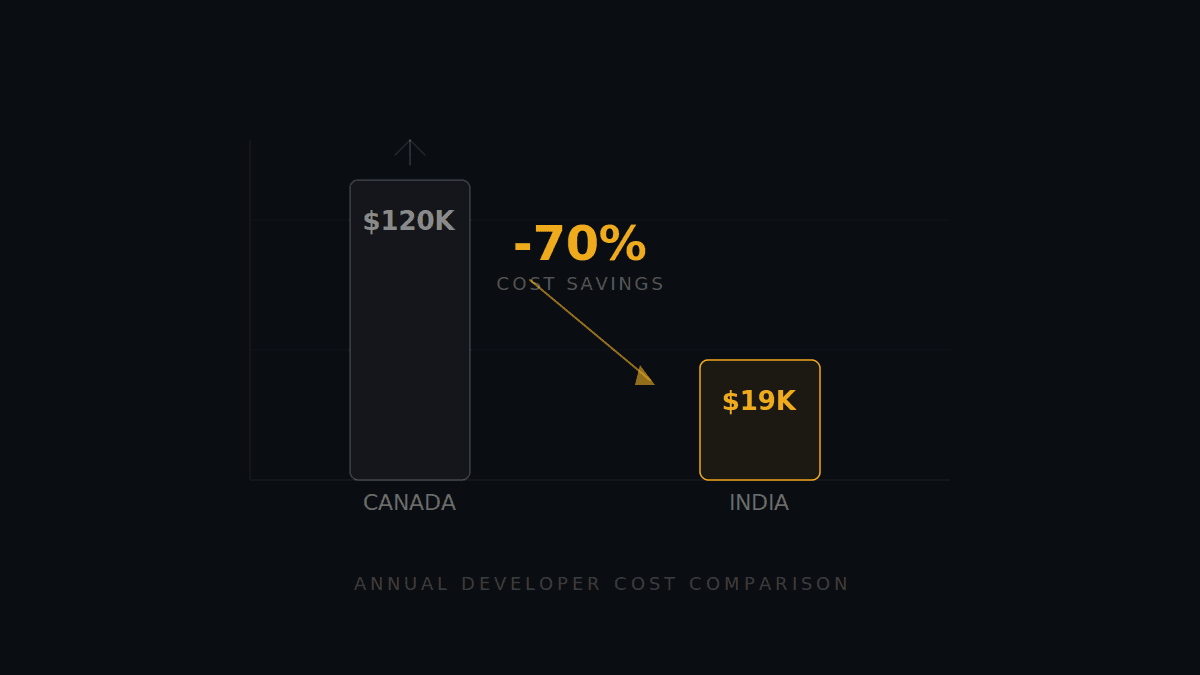

The cost saving is a big draw for US firms as no legal unit or admin staff is needed. The hidden costs are fees, currency change & less control.

Key Points Before Deciding

Number of employees

The EOR is good if you hire 1 to 5 staff. The in house model is good if the team will be large in time.

Speed & agility

The EOR is fast. The in house model takes time.

Nature of work

The in house model is good for special jobs & control of data & rights.

Budget & cost view

The EOR has steady fees. The in house model has big start cost & more costs for staff & law.

Compliance risk

The EOR is good if you do not want payroll risk. The in house model has high risk.

Tech & system needs

The in house model may give more links to HR & accounts. The EOR has set links but less free choice.

Sample Cost Comparison Table

Cost Type | In House Setup / Year | EOR Fees / Year |

Legal unit setup & care | ₹ 200000 – ₹ 500000+ | Nil |

Payroll tools & systems | ₹ 150000 – ₹ 300000 | Part of fee |

HR & payroll staff | ₹ 800000 – ₹ 1500000 | Low need |

Law & audits | ₹ 250000 – ₹ 500000 | Part of fee |

Statutory benefits | Same in both | Same in both |

Admin cost | Extra | Low |

Total | ₹ 1500000 – ₹ 3000000+ | ₹ 2000 – ₹ 5000 per worker per month + small care cost |

When In House Makes More Sense & When EOR Is Better

Go In House if

The plan is long term with large staff in many states.

The need is full control of HR & data.

The budget can pay for staff, law & systems.

The jobs are unique & need custom deals.

Choose EOR if

The need is fast hire with no unit setup.

The aim is steady & low start cost.

The team is small or growth is not sure.

The wish is to shift risk of law & payroll.

The goal is to cut risk of wrong job class or pay errors.

Steps for US Companies in India Payroll Setup

The US company must check EOR skill & past work.

The job terms, pay, rights & exit rules must be clear.

The state rules on tax, holidays & work laws must be clear.

The right payroll tools must be used for tax, pay, data & staff self service.

The law must be tracked as rules on pay, tax & work change often.

The money flow & pay in INR must be done as per RBI rules.

Conclusion

Complete India Payroll Management for US Companies needs wise choice. The EOR path is best for fast entry, less risk & no load of state rules. The in house path is good for large teams, custom needs & full control.

The key is to match your plan, risk view & growth goal with the right model.