The Remote Talent Payroll Compliance Singapore is a critical topic for companies hiring employees or contractors in Singapore. The payroll rules in Singapore are strict & precise covering tax contributions, employment laws & reporting. The guide walks you through compliance basics to help you build a reliable & legal payroll process for remote hires. Today, In this article, we will discuss about Remote Talent Payroll Compliance Singapore on SoTalented.

Understanding Payroll Basics in Singapore

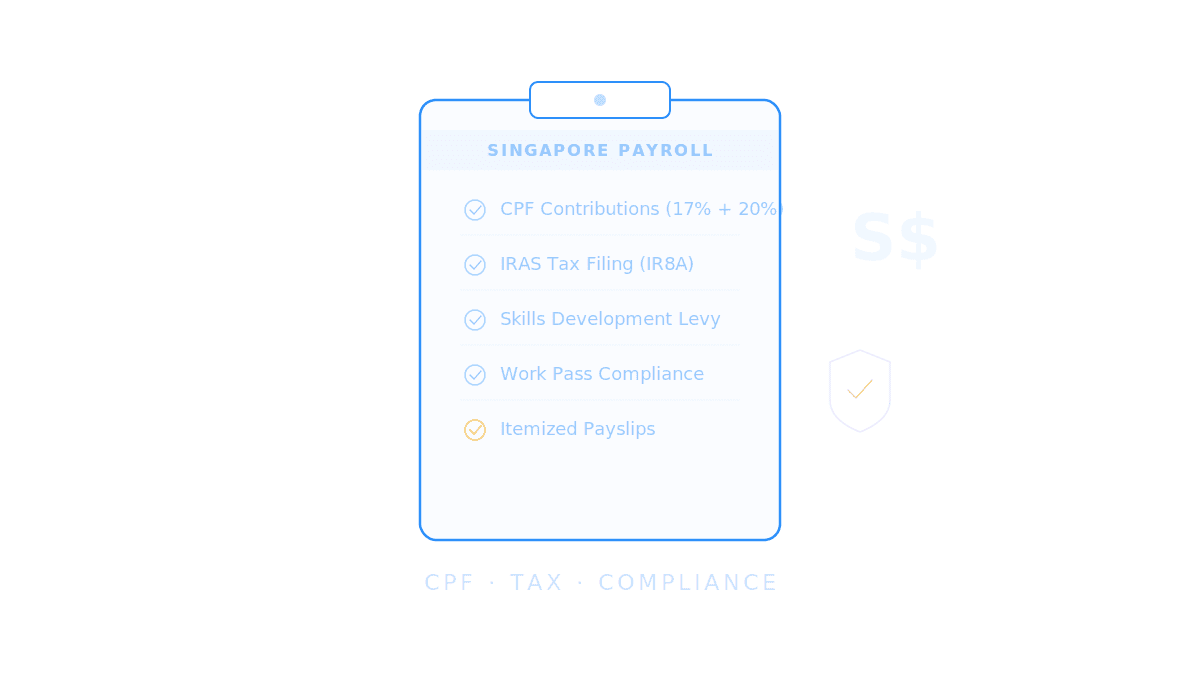

The Remote Talent Payroll Compliance Singapore involves several key parts.

The monthly payment cycles require salaries released within seven days after the pay period ends.

The issued itemized payslips must show gross salary CPF contributions deductions & net pay.

The employer must contribute to the Central Provident Fund CPF & make correct tax filings.

These parts form the base of legal & clear payroll operations.

Key Compliance Requirements

CPF Contributions

The CPF scheme mandates employer contributions for Singaporeans & Permanent Residents.

Employee Type | Employer Contribution | Employee Contribution |

Standard Rate | 17% of gross salary | 20% of gross salary |

Wage Ceiling 2025 | SGD 7,400 per month | SGD 7,400 per month |

These contributions support housing retirement & healthcare needs.

Payroll Deductions & Processing

The companies must

Issue payslips on time and with accuracy.

File forms like IR8A, IR21 for income reporting and foreign employee exit clearance.

Add skills development levy SDL and follow IRAS deadlines.

The missing of any step can trigger audits or fines.

Work Passes & Tax Residency

The remote hires in Singapore must consider

Employment Pass S Pass or Work Permit based on qualifications and pay.

Tax residency applies after more than 183 days in a year this impacts income tax duties & payroll withholding.

Non compliance can trigger Permanent Establishment PE tax duties for employers.

Payroll Compliance Checklist 2025 Snapshot

Area | Requirement Highlights |

Payslip Distribution | It can give Clear breakdowns monthly or within 7 days of pay period |

CPF Cuts & Reporting | It Must apply correct updated wage caps & contribution rates |

SDL & IRAS Submission | It Must meet deadlines with accuracy to avoid penalties |

EOR Vendor Compliance | It Must follow CSP Act & be ACRA registered |

Legal Workplace Permits | It can Confirm valid work pass & monitor tax residency risks |

Employer of Record EOR as Compliance Solution

The EOR providers make Remote Talent Payroll Compliance Singapore simple.

They handle payroll CPF tax filings and work passes with local knowledge.

They stay updated on CPF rate changes SDL IRAS and ACRA rules.

The platforms make payslip generation & compliance alerts easy with less manual risk.

Common Compliance Pitfalls & Prevention

Payslip or payment delays

The use of automated payroll tools keeps you on time & correct.

Incorrect CPF calculations

The systems that auto update based on CPF ceilings & age groups can fix this.

Lack of SDL and IRAS tracking

The platforms that remind and file on time can help here.

Unauthorized EOR vendors

The vendors must be checked for CSP Act registration & AML CTF rules.

Strategic Tips for Compliance Success

The choice of cloud payroll platforms made for Singapore rules is key.

The check that your EOR handles CPF tax & SDL flows in the right way.

The updates on CPF ceiling changes must be tracked for 2026 too.

The compliance must be planned even for short term or freelance remote hires.

The audit ready records for at least two years must be stored by systems.

Conclusion

The Remote Talent Payroll Compliance Singapore is a crucial part of building a strong remote team. The CPF payroll processing tax reporting & employment pass rules must be managed with care & support of automated tools. The compliance keeps your company safe from legal risks & helps build an efficient & trusted remote hiring model for the future.

Looking for a trusted partner, then SoTalented is Here to Help Grow Your Business!